(All posts may contain affiliate links. Please see my disclosure policy)

Money is something that concerns us all. Whether you’ve got too much or too little of it, it’s always wise to keep an eye on your finances. If you’re trying to save money or you’d love to have more disposable income at the end of the month, planning ahead is really helpful. If you thought financial planning was stressful, think again. With this guide, you can get to grips with your finances and start preparing for the future with minimal hassle.

Assessing your financial situation

Many of us have online banking, which enables us to check our balance on a regular basis, but if you’re one of those people who tends to shy away from balance inquiries or leave letters from the bank unopened, you may not be aware of your financial situation. Sometimes, it’s easier to be an ostrich and bury your head in the sand, but it’s advisable to take control of your finances. The best way to start doing this is by seeing where you are in terms of what you have available, what you’re saving, and whether you have any debts.

Before you do anything else, sit down with a pen and paper, check all your balances, and work out what you’ve saved, what you own on credit or store cards, and how much you have outstanding on loans and mortgages. Once you’ve got figures written down in front of you, you’ll have a much more accurate picture, and this will help you to draw up plans moving forward.

(photo credit)

Learning to budget

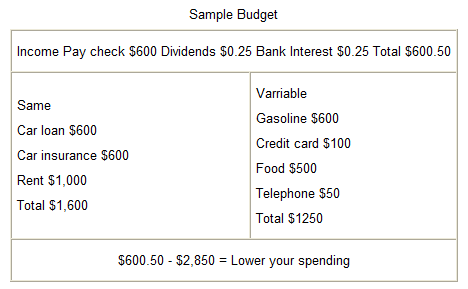

It’s very hard to save money or reduce spending if you don’t have a budget. Budgeting enables you to see where your money is going each month and to work out what you can spend, and if you can save. To work out a monthly budget, all you need to do is compare what you’ve got coming in with what’s going out. In one column, you’ll probably have your wages. In another, you’ll have mortgage or rent payments plus bills and living costs, such as groceries and gas. In a different column, add any other costs you expect to incur that month, such as gifts for your child’s birthday or spending money for a family vacation. Some months will be more expensive than others, and budgeting enables you to adapt your saving and spending plans accordingly. If you use an app or you do your budget on a computer, you can adapt and update it as you go along to make sure your budget is accurate.

(photo credit)

Bouncing back from bad credit

If you’ve got bad credit, it can affect your ability to borrow money, so it’s always a good idea to try and improve a low credit score. Your credit score is based on the level of risk you present to a lender. If you have a history of missing payments, for example, you’ll have a lower score than somebody who has paid off a loan and makes regular contributions to their credit card. If you have bad credit, it may be worth getting in touch with a credit repair company, which can help you increase your score. There are lots of different companies out there, so articles like CreditRepairCompanies review of Sky Blue Credit may come in handy if you’re not sure which firm to go for. You can also improve your rating by ensuring that you keep up to date with repayments for loans, mortgages, and credit cards, and by using your account on a regular basis. You don’t have to be in debt to have a poor score. If you don’t use your account much, you may also have a low rating.

(photo credit)

Finding ways to save

Once you have a good idea of how your finances are looking, you can think about ways to save more.

If you’re spending money on interest every month, there may be ways to reduce spending. If you have a credit card, for example, look around for banks and lenders that are offering 0% interest on balance transfers. If you switch, you can pay off the balance as you go without incurring additional interest fees.

There are several easy ways you can save money around the house, especially if you don’t already adopt a regimented approach to shopping, energy usage or finding the best deals. One of the best (and the quickest and easiest) ways to save money is to fire up your laptop and compare the price of house, car, and health insurance, TV and broadband, and gas and electricity. The fees you are currently paying may be significantly higher than those available for new customers, and you can often save a ton of money by switching to different providers.

Once you’ve negotiated a better deal on energy, you can also cut bills further by paying more attention to the amount of energy you use. Simple things like turning lights off, and using a smart meter could save you a lot of money. It’s also really helpful to be more disciplined when it comes to food shopping and to save money on social activities. You don’t have to become a recluse to boost your savings account balance. Invite people over rather than going out, investigate free events, and swap movie nights for a DVD and takeout. You don’t have to change your life radically to notice a difference.

(photo credit)

Making your money work

If you’ve got money to save, it’s worth doing some research to find the best ways to make your money work for you. Interest rates on savings accounts are pretty low at the moment, but there are other ways of making money. You could consider investing in property, for example. If you’re already a homeowner, renting a house or an apartment out could earn you money now, as well as increasing the value of your estate in the future

(photo credit)

Many people will roll their eyes when the words financial planning crop up, but it’s always helpful to be aware of your financial situation and to take steps to save money. If you’re not a meticulous planner, hopefully, this guide has given you inspiration to get a grasp on your finances and start planning for the future.