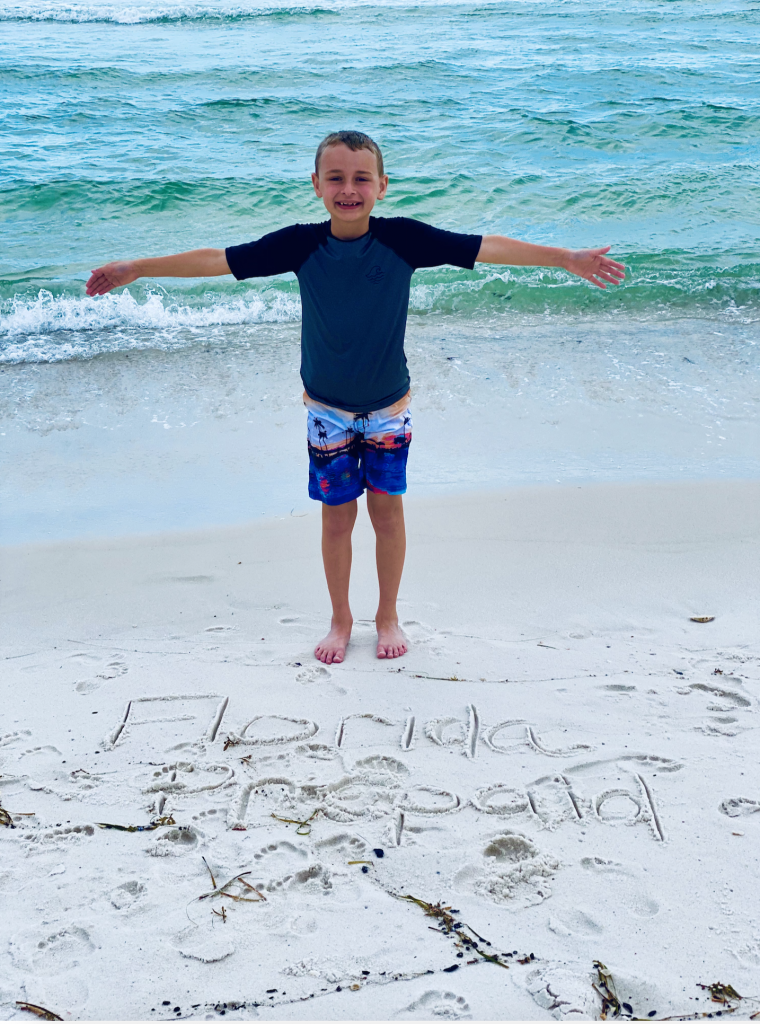

Help your children dive into their future dreams and goals with help from a Florida 529 Savings Plan! Use promo code SWEET529 and $50 will be contributed to your account. This post is sponsored by Florida Prepaid College Savings Plans. All thoughts and opinions are my own. Please see my disclosure policy.

When you stop to think about your child’s future education how does it make you feel? Are you nervous, anxious, excited? I would be lying if I told you that I wasn’t anxious about Drew heading off to college in just a few short years. I start thinking about all the “what-ifs” and wonder, “Are we ready for the future?” “Are we financially prepared for this huge investment into our son’s life?” I am happy to tell you that the answer is YES! We feel empowered and in control with this decision thanks to help from Florida Prepaid College Plans.

Preparing for your child’s future education doesn’t have to be scary. What if I told you that with one small step you could open so many possibilities and happiness for your children? When you open a Florida 529 Savings Plan, you can rest assured in knowing that your child can have a debt-free future ahead of them. A Florida 529 Savings Plan is the easy and affordable way to save for college. I am also happy to tell you that the Florida 529 Savings Plan has been ranked as one of the nation’s top-10 performing 529 Savings Plans by savingforcollege.com! This fabulous news is sure to give you that “529 Feeling!”

I have some exciting news that will have you diving into the waves of summer! Through August 15, when you open a Florida 529 Savings Plan and use promo code SWEET529, Florida Prepaid will seed your account with $50 in free money! That is double the amount that they offered last year! This means that there really is no reason to hold off on planning and saving for the future.

My Top FIVE Top Reasons Why You Should Open a Florida 529 Savings Plan:

- The Florida 529 Savings Plan is a low fee and tax-free way to save for college. Unlike a savings account or mutual fund that is going to get hit with income taxes, your contributions toward your 529 Savings Plan will earn interest and will not be taxed when the money is taken out to pay for college or other qualified education. Investment earnings are not taxed if they are used for these expenses, including tuition, fees, room, board, books, and supplies.

- The Florida 529 Savings plan is by Florida, for Florida. While you may use this plan at any institution (even outside of Florida), the Plan is only for Florida residents. Florida Prepaid makes saving for college easy and exclusive just for Florida families. This is yet another perk to living here in the Sunshine State!

- It is free and simple to sign up for a Florida 529 Savings Plan. Not only has Florida Prepaid made saving for college easy and simple, but they have redesigned their website so that it is user-friendly. This means that planning for your family’s savings goals is even easier than before! Florida Prepaid wants to ensure that every Florida family can save affordably for college. Be sure to use the Saving Tool on the website to see just how easy that you can watch your savings and investments grow! You can also choose from three investment paths. I would suggest that you pick the path that best suits your family: simple, intermediate, and advanced. The simple, or age-based portfolio is the most popular investment option and is fully managed. I love that Florida Prepaid handles all the details!

- The Florida 529 Savings Plan is very flexible! I don’t know about you, but flexibility while planning towards the future is a key factor in our family’s decision making. I love that this plan allows our family to save WHAT we can WHEN we can as our budget allows. Even the smallest amounts saved now can add up to so much possibility towards our kid’s futures! Did you know that just $25 a month can grow to nearly $9,000 over 18 years? Every amount really does add up to let you meet your savings goals.

- The Florida 529 Savings Plan can be used toward qualified K-12 expenses. Say what? Yes! Many people don’t realize that your Florida 529 Savings Plan can be used for up to $10,000 annually on qualifying K-12 expenses such as tuition and mandatory fees associated with enrollment or attendance at an elementary or secondary public, private, or religious schools.

Statistics have shown that children who have even a small amount of money saved toward their college education are 2.5 times more likely to graduate from college. What are you waiting for? Dive into savings and start planning for your children’s future this summer! Remember, you can get $50 for FREE contributed to your account when you sign up for a Florida 529 Savings Plan and use promo code SWEET529. You must HURRY though as this promo is only good through August 15!

Be sure to follow Florida Prepaid College Plans on Facebook, Twitter, Instagram and YouTube to stay up to date with information on open enrollment, tips and promotional offers.